Stepping into stock trading is both thrilling and alluring as it has potential to be an additional source of consistent income or at least a way to grow your savings. But without proper knowledge of stock markets and without properly analyzing the stocks you run a risk of loosing your money in unrewarding disastrous trades.

Here in this post you would venture into five essential tips that would help you to navigate stock trading with confidence and make profitable trades consistently. These tips will let you make smart trading decisions and thus would boost your chances of success in your trading journey.

So let's begin-

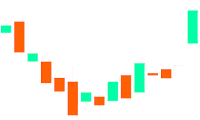

1) Always do Trend Analysis- Trend analysis is initial and crucial step in technical analysis but quite often beginners ignore this critical step and rely excessively and exclusively on indicators and make costly trading mistakes .

Analyzing trend in a stock gives important insights about stock's direction and enable us to make important decisions like ,whether to buy or sell an asset or stay away from trading. For example, you would like to be on buy side if a stock is in uptrend.

Even the choice of indicators to be used for trading largely rests on trend analysis. For example Oscillators are best used in sideways market and Moving Averages give better results in trending stocks.

2) Don't trade against trend- Trading against trend means taking positions that is contrary to the overall stock or market movement. For example , buying a stock during pullback which is visibly in downtrend. Trading against trend increases the possibility of losses.

When you trade in the direction of overall trend of stock ,you align yourself with the stock's momentum and enhance your chances of a successful trade. So, always remember trend is your friend and you shouldn't leave your friend !

3) Analyze in multiple time frames - Analyzing a stock in multiple time frames lets you get a comprehensive view of the stock price movements that lets you make important trading decisions like accurate entries and exits.

A higher time frame give important insights into the overall trend of a stock while smaller time frames let you plan precise trade entries and exits.

4) Understand your Indicators- Indicators are tools that aid you in making important trading decisions but ultimately it is you who has to decide how are you going to use it. Even best of the tools would give disastrous results in unskilled hands.

So, it is important to have exhaustive knowledge about the indicators you use. For example, Stochastic, an oscillator works best in sideways market while MACD, a momentum indicator better be used in trending markets.

5) Always do volume analysis- Volume analysis is one step that is most often ignored particularly by beginners. Price action undoubtedly is the most important data that you have but adding volume analysis to it validates the price movement. For example, increasing price with higher volume means there is strong buying interest. further, understanding volume trends along with price movements help to differentiate false signals from the genuine ones.

Hope you liked the post and would consider applying these tips while trading.

Post a Comment